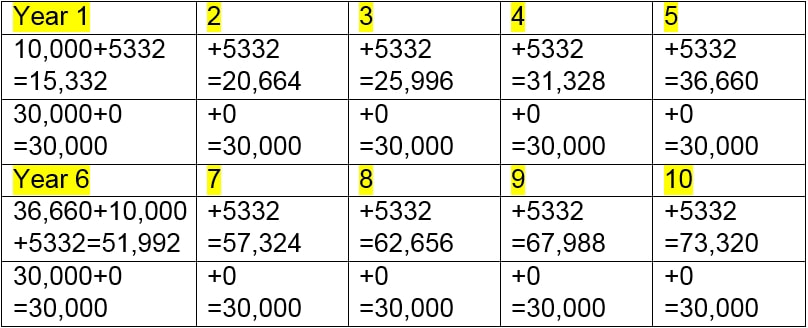

What is this? A plumber type, writing an article on money?? The world is indeed a mysterious place… Well, you may remember that I wrote an article about “Asking the Right Questions”. That was from this blog, September, 2017. It seems to me that asking a good question about the way we view costs could be useful. You know that in our basic schooling in America, we get next to no education on finances and how money works. It’s up to us to figure it out for ourselves or find people good at money who can mentor us. I’m some mix of the two. To define some terms here, “first cost” is just what it sounds like… “Life cycle cost” is different in that it takes all costs over time, and factors them in, to help one see what is a deal and what isn’t. What does something really cost? Let’s use a current example. Let’s say you want to buy a car, but you don’t imagine you have budget for something expensive, like a Tesla, so you’re looking at older Chevys. Just for fun, in comparing prices, you find a used Chevy for $10,000 and a used Tesla for $30,000. Let’s assume both cars already have 100,000 miles on them. Well, it seems obvious that you’ll save $20,000 by getting the Chevy. That’s first cost thinking! Now let’s do this a different way. How many years will you get from the Chevy? If you maintain it well, you might get 100,000 more miles from it before it turns into a pile of oily rust. If you drive 20,000 miles per year, that’s five years before starting over again. The Tesla, because it’s mechanically far simpler than the Chevy should be good for 1,000,000 miles. (I did not make that up!) That means you’ll have 900,000 miles of driving before it turns to e-dust. That’s a good 45 years of driving at 20,000 miles per year. So, just from a replacement point of view, for $10,000 you get five years, or the cost of the Chevy is $2000 per year. Now, for $30,000 you get 45 years with the Tesla.That yearly cost is $667. Hmm, a savings of over $1300 per year! But wait, there’s more :~) Let’s say the Chevy gets 15 miles per gallon. That’s 1,333 gallons of gas at $4 per gallon or $5332 for gas for one year. Some of the older Teslas come with free power for life… even for subsequent owners. So, that’s another chunk of yearly savings. There are other costs, like insurance and maintenance. To simplify this discussion, let’s just say those are the same for both cars, but we know that the gas vehicle will have higher maintenance costs than the electric one. So, now let’s look at the yearly costs for both vehicles and determine how the life cycle costs compare. Initial cost are $10,000 for gas and $30,000 for electric.Gas vehicle costs are $5332 more per year than electric, but we can only extend this out for five years because the gas car then turns to rust. Then we repeat the cycle. So, over ten years, the Tesla costs $30,000 and the Chevy (replaced once) costs $73,320! If you kept the Tesla for its full million miles, you would save something close to $300,000. That’s a nice little nest egg! The price of admittance was the $20,000 more for the Tesla, but it saved you $5332 in fuel every year along with purchase price savings of over $1300 per year. In fact, the break-even point is just around four years. After that you’ll be money ahead. Ultimately, that $20,000 investment made you $43,320 after ten years, or as much as $300,000.Not bad! Oh wait! That money doesn’t need to sit there just getting moldy earning the same or less than the rate of inflation in a bank account. You get to invest it in something you know a lot about, like your business. I’ll be bringing up a tool (a saw) I got long ago in a little bit.With that saw, I built lots of things that people paid me for. I built decks, houses, and did remodel work… all using that saw. Way back when, the saw cost me around $35 or $40.It has helped to make me many tens of thousands of dollars. It really pays to invest in things that make you worth more to others, whether physical things or education. Doing this, that $300,000 could easily become millions. I like to ask myself when looking to buy something, “How cost effective will this be?” It’s a good way to differentiate between investment and entertainment. It may be said that this was an extreme example, using cars chosen to make the point, but it applies to so many areas of life. When I buy tools that I know I’ll use a lot over time, I get good ones. I still have a Skillsaw that I got over 45 years ago. A cheap saw would have worn out many times over. When I’m looking for a tool for one time or rare usage, something cheap is just fine. Investments that save energy also fall into the category where they can be judged for cost effectiveness. Yes, saving energy helps save the planet too, but I don’t wish to descend into politics. For this talk, we can look at “simple payback”, where, if a ten dollar investment in energy conservation saves a dollar per year, it pays for itself in ten years. But, also consider that if this was invested in your home, when the home is sold, you likely will get the entire ten dollars back as efficiency is something the new owners are likely to be interested in because it will save them money too.So, very roughly, instead of just paying for itself, your money was doubled. So, consider asking the life cycle cost vs first cost question when you are looking at purchases, big and small. And know that investing in you is likely one of the best investments you can ever make. Yours, Larry

0 Comments

Leave a Reply. |

Larry Weingarten

Looking back over my working life of 50+ years, it seems clear that self sufficiency has always been the best way for me to be useful. Now, mix in a strong interest in water in its many forms and the wide world of animals and you'll know what's important to me. Archives

January 2023

Categories |

Copyright © 2014 - 2023

All Rights Reserved

All Rights Reserved

RSS Feed

RSS Feed